From Mesopotamia to ancient Rome, it seems tax collection has been around since the beginning of civilization. And, while many may find them a burden, the tax records left behind are priceless to any genealogist.

United States tax records date back to colonial days and can bridge gaps left by decennial censuses and other types of record keeping. The annual nature of tax collection gives researchers an excellent source that can be used to trace their ancestor’s lives and discover valuable details not apparent in other kinds of documents.

To get started using these records in your family history research, you’ll first want to become familiar with the several types of tax records available and learn where to find these valuable documents.

Editor’s Note: While this article cover U.S. resources, many of the resources and tips are relevant to research anywhere in the world. Many countries have extensive tax-related records available so take the time to find out if you can discover collections for your region of interest.

What kind of tax records can help you research your family’s history?

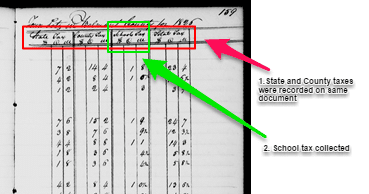

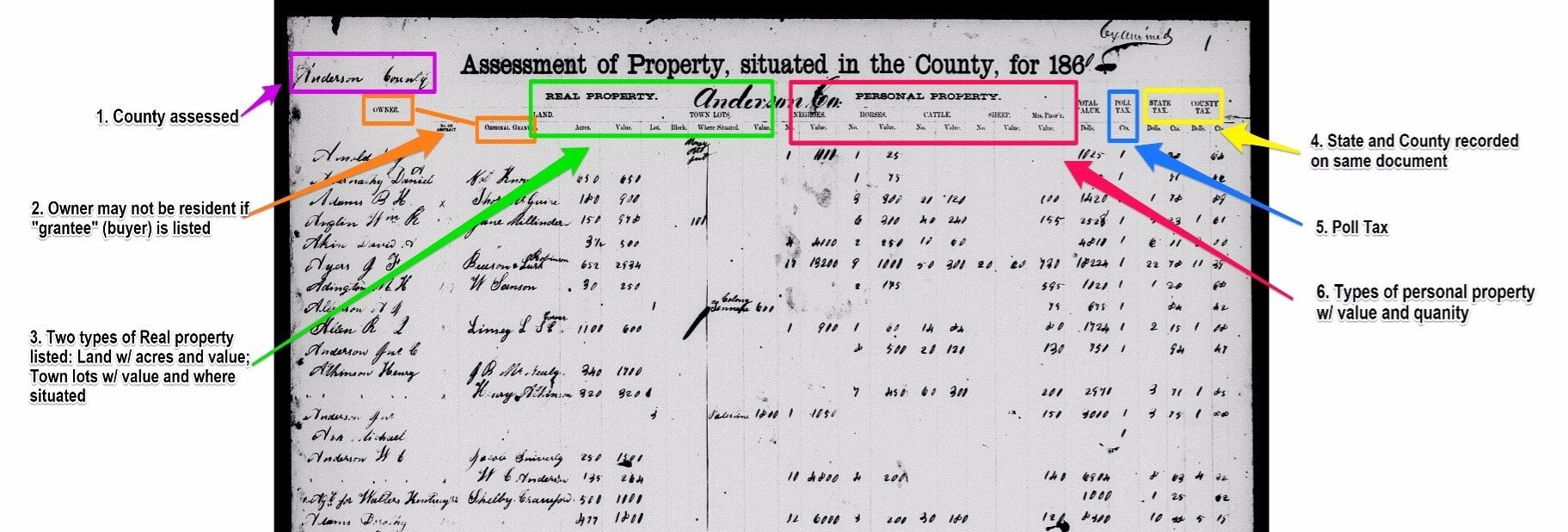

This article refers mainly to direct tax records in the United States and provides examples (at the bottom of the article) to refer to. While digging into these tax documents you will find several types of taxes and records at all levels of government including local (towns, townships, cities, etc.), county, state and federal. At lower levels of government several types and levels of taxes may be collected on the same document (Example 2 #1; Example 3 #2, 6 at bottom of article).

While most types of tax were assessed annually, federal direct taxes were sporadic prior to the modern income tax that began in the early 1900s. Federal taxes were levied in 1798 and 1810, from 1814 to 1816, and from 1862 to 1866. 1810 records do not exist for every state due to an option for states to pay in lieu of directly taxing citizens.

Here are the most common types of tax records you will encounter:

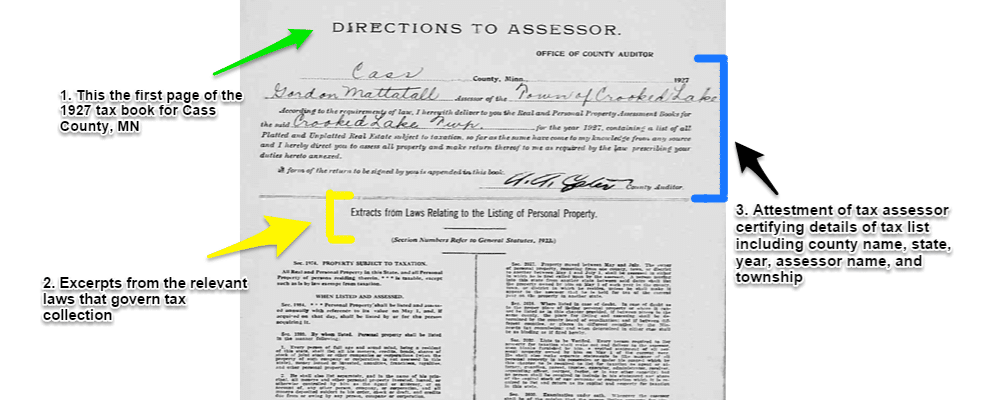

- Poll, tithable, or head (Example 3 #5) – This was a common tax assessed to every adult male and was often recorded with land and property tax. Be aware of relevant local laws pertaining to the age of taxable adults, which may be found on opening pages of said record (see Example 1) or by searching for local statutes for the time.

- Real Property (Example 2 #3) – This tax was levied on land owned. Be aware that some jurisdictions taxed the person using the land (renters) rather than the actual owner of the land, or you may see both names listed (Example 3 #2).

- Personal Property (Example 3 #6) – Taxes were often levied upon various types of personal property including livestock, carriages and enslaved persons.

- Quitrents – Quitrents were a tax levied by some colonies prior to American independence and were paid to a Lord or the English Crown. Quitrents were also sometimes levied by town founders prior to the incorporation of government to fund community projects.

- Other (Example 2 #2) – Taxes varied between jurisdictions and sometimes included taxes outside those listed above such as those for roads or schools.

There are many important details about your ancestors that you may be able to discover from tax records

The information recorded on tax lists will vary, but the following important information can often be found on tax lists (See Example 3 for an example of many of these on an 1860 tax roll in Anderson County, TX.):

- Name of taxpayer, usually white adult males

- Town/township/city, county, and state of residence

- Owner and/or renter of property

- Number of white adult males in home

- Type and value of property taxed

- Number of school-aged children

- Number of enslaved persons

- Types of property owned

Many other less obvious details can also be discovered with a little detective work:

Year of birth

An individual’s year of birth can be pinpointed by tracing his name in reverse chronological order. Generally, the earliest year he is listed in tax records is the year he became a legal taxpaying adult. Age of adulthood varied between jurisdictions but usually ranged from age 16 to 21. Many tax lists cite the applicable laws at the beginning of the records (see example 1). For example, if Joe Smith first appears in the list in 1880 and his county states all white males 16 and upwards must pay taxes, you can surmise that Mr. Smith may have been born around 1863 or 1864.

Parentage

Like the year of birth, parentage can be discovered through tracing a relative’s name in either chronological or reverse chronological order. If a previously unlisted male appears on the tax lists next to an individual with the same surname he is likely the son of said relative.

Year of Marriage

Usually single adult men were listed in a separate column (“single freemen”) from head of households. When they first appear as head of household this indicates marriage.

Year of Death

An individual will disappear from the records either due to his death or aging out of tax obligation. Aging out typically occurred between 50 and 60 years. Applicable law may be listed on the first page of the record (Example 1). You can confirm the year of death by searching for a listing related to the estate of the individual.

Occupation

Sometimes an individual’s occupation is listed. Often the absence of a listed occupation indicates occupation is a farmer. Occupation or other descriptive details may also be noted if there are two people with the same name.

Location

Similar to tracing age or death, relocation can also sometimes be discovered. If an individual disappears in a county/township he may have moved. Search nearby jurisdictions for similar details of the individual in question.

Keep in mind, there can be some drawbacks to using these records for your genealogy research

As with any source, there are few things to remember when using tax documents for researching your family history:

- Usually only white males of legal age are listed. Therefore, you will not find enslaved persons, women, other minorities or any person legally barred from owning land/property at that time. Sometimes a woman is listed in the event of her husband’s death.

- Many records are not easily accessible online and may take in-person visits to specific facilities. See below for more information on this topic.

- Tax laws may vary between jurisdictions and it will help if you are able to locate specific laws for the area. These are often included with the tax lists (see example 1 below: the first page of the 1927 tax assessment book for the town of Crooked Lake in Cass County, MN).

So, where can you find free tax records to use in your genealogy research?

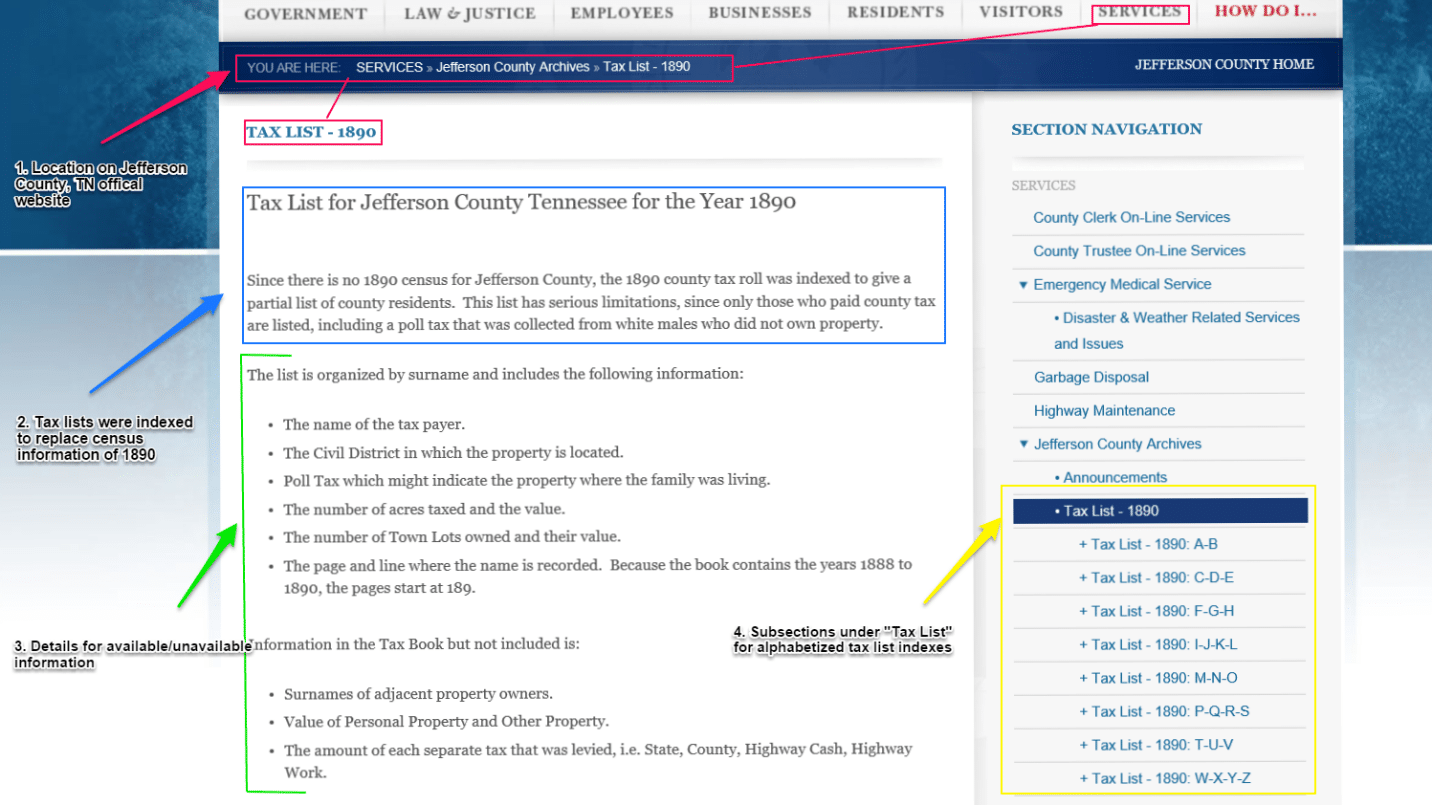

Unlike census records, only a portion of tax documents are digitized due to the sheer number and varied origins of these documents. Sometimes they might be made available digitally for years where census information was lost (Example 4).

Some records might also be digitally indexed for online viewing without access to the original document (Example 4), or are digitized but not indexed and can not be searched (but can be browsed).

- FamilySearch has a few online collections, and they can be found by searching for “tax” in the online records catalog.

- Ancestry has a variety and some are free, although many of them are only available to paid subscribers.

- MyHeritage also offers some collections to take a look at.

- The Digital Public Library of America and Internet Archive are also good places to search and find free tax records online.

Additional Collections

Availability of additional digital or indexed records, as well as offline collections, will depend on the state and local area of interest. You will need to do some research to find out what is available for your area of interest. You can use the resources below to find specific facilities and websites for inquiries.

ArchiveGrid: ArchiveGrid catalogs the content of more than a thousand institutions that hold millions of primary sources available in print. A generic search for tax lists or quitrents will yield an extensive list of materials along with information for locating these sources offline. The catalog also provides a description of item and contact information for the facility. Learn more about how to use this free resource in our article on the topic here.

OCLC WorldCat: WorldCat is a vast network of library catalogs. Users can search a topic or specific item to find nearby libraries that have this item available. When searching for tax records, WorldCat will direct to the closest libraries with this content and provide detailed information on the item.

FamilySearch Research Wiki: FamilySearch’s free research wiki contains an article on United States Taxation with general information on locating these records. In addition, there are individual wiki articles for each state with a subsection for “taxation” for many of them. This provides exact information on how to access any available records through FamilySearch (online or at local centers) and provides information for external sources.

Red Book: American State, County, and Town Sources: Red Book (ed. A. Eichholz, Ph.D., CG.) is comprehensive state by state reference book specific to researching historic records in the United States. Red Book was digitized by Ancestry and is available free in wiki form. On the main Red Book wiki page, all states are listed and linked to the state’s section. Within each state section you will find a subsection entitled Tax Records that details how and where to find these records for the state.

Our article Free Genealogy Research Sites for Every Single U.S. State lists two free research sites for each state – some of these may contain tax records or information about where to locate offline records.

Some Additional Notes

Many tax records are available to view in person at town clerk/repositories; county courthouses, historical societies or repositories; state historical or genealogical societies; and the National Archives and Records Administration (NARA) and regional facilities. A Wikipedia list of historical societies is available here.

There is also a searchable list of genealogy societies through the National Genealogy Society. The FamilySearch Center in Salt Lake City or local facilities also have a selection of both lower level and federal tax records. Some of these records were also published in journals or books and can be found at your public library.

Example Tax Records

Example 1: Pg. 1 of 1927 tax book for Crooked Lake Township, Cass County, MN.

Example 2: 1860 Tax List for Somerset Township, Belmont, Ohio. FamilySearch: Ohio Tax Records, 1800-1850

Example 3: 1860 Tax List for Anderson County, TX. FamilySearch: Texas County Tax Rolls, 1837-1910.

Example 4: Jefferson County, TN official website (Showing the availability of tax lists information through county sources, example of indexed tax lists to replace lost census information, and where to find digitally indexed tax lists.)

Historical tax records are a rich resource for genealogists willing to invest a little time. While not as easily accessible as census records, tax lists can offer a means to trace ancestors throughout much of their life and, in the process, discover fascinating pieces of family history.

By Jessica Grimm, Associate Writer, Family History Daily

You might also like:

Voting Created Some Fascinating Records: Here’s Where to Find Them

The Ultimate Quick Reference Guide to the U.S. Census for Genealogy

Image: People filling out IRS tax forms 1920

This is very helpful information. Thanks! I had not thought alot about tax records. Hopefully I will be able to find some to break through my brick walls.